A raft of foreign capital investments across new and existing mines in Papua New Guinea are set to boost production and lead to a rebound in government revenues.

However, the Oxford Business Group (OBG) says there are concerns proposed legislative changes could hinder activity moving forward.

In December Australian company Newcrest Mining and its partner, South Africa’s Harmony Gold, signed a memorandum of understanding (MoU) with PNG’s government over a potential PGK9.1bn ($2.8bn) investment to develop the Wafi-Golpu mine, a copper-gold asset in Morobe Province.

While the MoU will not immediately lead to progress on the mine, it paves the way for further talks and a possible final agreement that will delineate benefit and revenue-sharing arrangements between developers and local communities. The developers hope that with the timeframe for negotiations set by the current MoU, a special mining lease – the specific type of permit relating to large-scale, long-term projects – can be issued by the end of second quarter of this year.

Potential developments at the Ramu and Frieda River mines

Separately, on January 1 Toronto-listed Cobalt 27 Capital announced a deal to purchase Australia’s Highlands Pacific for an estimated $70m, which will see the former potentially obtain a 11.3 percent stake in the Ramu nickel-cobalt mine.

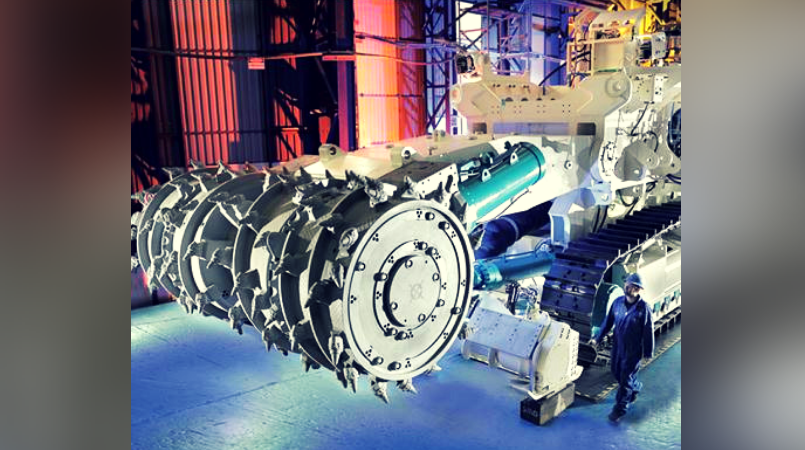

Ramu currently produces around 3300 tonnes of cobalt annually, approximately 3 percent of annual global supply, and 34,000 tonnes of nickel.

The mine is estimated to have a remaining life of 30 years and its majority owner, Metallurgical Corporation of China, is mulling a potential expansion to the tune of $1.5bn, to which Cobalt 27 would become involved upon the completion of its transaction.

Details for the expansion have yet to be finalised. However, given the plant’s original cost of $2.1bn upon commission in 2012, the proposed budget would represent a significant upgrade.

Highlands also owns a 20 percent stake in the giant Frieda River copper-gold project, which is to be sold off to Australia’s PanAust – the mine’s operator and 80 percent shareholder – as part of the deal with Cobalt 27. The mine is thought to contain 13m tonnes of copper and 595 tonnes of gold.

PanAust recently completed a feasibility study that estimated Frieda’s operational lifespan at 33 years, surpassing a previous 17-year estimate. However, the site would require some PGK20bn ($6bn) in both direct and supporting infrastructure investments to realise its potential, the company said, with significant input needed from the government. As such, given the squeeze on its state finances following a difficult past year, this project is unlikely to come on-line in the short term.

Extractive investments key to national development

These new investments in the extractive industries could help boost overall national growth, given the sector’s importance to the economy.

Extractives account for around 25 percent of GDP, according to government estimates; however, revenues declined significantly last year following the February 26 earthquake that struck the Hela Province.

The incident killed around 200 people and severely damaged much of the country’s key industrial infrastructure, dampening 2018 year-end growth estimates to 0.3 percent, down from a high of 2.4 percent at the start of the year.

“The earthquake shows how significant the contribution of the resources sector is to the PNG economy, and serves to highlight its sensitivity to major national and international shocks,” Peter Graham, CEO of the state-owned Kumul Minerals Holdings and managing director of Ok Tedi Mining, told OBG.

However, these new investments, along with a stabilisation of extractive activity, are expected to lay a platform for growth this year.

Investors raise concerns over new mining regulations

While the government has been keen to stimulate investment in the extractives sector, officials have sought to balance the needs of foreign investors with the development of homegrown companies and communities, with new proposals that may cool international interest.

A series of proposed amendments to the 1992 Mining Act, which are currently under discussion by the government, could see fundamental changes to the regulatory regime governing the sector.

If implemented, the reforms could see the maximum term of a mining lease reduced from 40 years to 25 years and the renewal period for a mining licence reduced from 20 years to 10 years, while also granting the government the right to acquire the ownership of a mine upon the expiry of the first term of the lease.

Furthermore, the proposed changes include policies regulating fly-in, fly-out employment practices, by which some mining firms rely on temporary foreign labour, rather than Papua New Guinean workers, or permanently domiciled foreign workers.

However, these proposed changes have been met with concerns from industry players. The PNG Chamber of Mines and Petroleum, which represents the interests of companies operating in the sector, stated that the proposals risk hampering growth by hindering investment in the country, along with the technology- and skills-transfer benefits that are often associated with foreign-funded projects.

This Papua New Guinea economic update was produced by Oxford Business Group.